Warren Buffett on Economic Moats 畢菲特的護城河理論

1999年,股神畢菲特在一個與財富雜誌 (Fortune) 的面談裡,提及「護城河」(economic moats) 一字,來形容他投資策略上的主要考慮。根據一篇2018年刊登在財經資訊網站 Markets Insider 的文章,畢菲特是這樣形容企業「護城河」的:

'The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage of any given company and, above all, the durability of that advantage. The products or services that have wide, sustainable moats around them are the ones that deliver rewards to investors."

投資的要訣在於判斷哪一家公司有競爭優勢,特別是能否長期保持該競爭優勢。如果公司的貨品或服務有遼闊和具持續性的護城河,那麼該公司將會為投資者帶來可觀回報。

根據另一篇文章刊登在 Nasdaq 網站,畢菲特其實曾經多次公開闡述護城河對投資者的重要性:

"I like businesses I can understand. We'll start with that. That narrows it down about 90%. There are all kinds of things I don't understand, but fortunately, there's enough I do understand. You got this big, wide world out there. Almost every company is publicly owned. You got all American business, practically, available to you. Now, to start with, it doesn't make sense to go with things you think you can't understand. But you can understand some things. I can understand this (picks up can of Coca-Cola [KO]). I mean you can understand this. Anybody can understand this. I mean this is a product that basically hasn't been changed much since 1886, and it's a simple business. It's not an easy business. I don't want a business that's easy for competitors. I want a business with a moat around it with a very valuable castle in the middle. And then I want the duke who's in charge of that castle to be honest and hard-working and able. And then I want a big moat around the castle, and that moat can be various things."

撮要如下:

- 要投資於自己能夠理解的企業,這樣可以大大減低選股的難度

- 可口可樂公司是一個例子,自1886年來,他們的產品差不多從未改變,業務簡單而且容易理解;但對競爭對手來說,與可口可樂爭奪市場卻甚為困難

- 我不希望投資於一個能輕易被競爭對手搶佔市場的企業

- 我希望投資的企業,要能創造大量經濟價值,而且被護城河包圍著

- 我希望企業的管理層勤奮而能幹

"The moat in a business like our auto insurance business at GEICO is low cost. I mean people have to buy auto insurance so everybody's going to have one auto insurance policy per car, basically, or per driver. And I can't sell them 20, but they have to buy one. What are they going to buy it on? They're going to buy it based on service and cost. Most people will assume the service is fairly identical among companies, or close enough, so they're going to do it on cost, so I gotta be the low-cost producer. That's my moat. To the extent my costs get further lower than the other guy, I've thrown a couple of sharks into the moat."

- 巴郡旗下的汽車保險公司GEICO擁有一道護城河,就是低成本優勢

- 駕駛者必須要為自己的汽車購買保險,即使GEICO不可能向一位駕駛者賣出20份保險,但對於駕駛者來說,有一份汽車保險是必須的

- 哪麼駕駛者購買保險時會考慮什麼因素呢?駕駛者會假設所有保險公司的服務差不多完全相同,所以保單價格會是他們重要的考慮

- GEICO設法降低成本,向駕駛者出售價格低廉的汽車保險

- 這是GEICO的護城河,我們的價格比競爭對手低,情況就像我把鯊魚放進護城河裡(意思是:任何人想越過護城河攻進城堡,都必先要解除鯊魚帶來的威脅;即是比喻競爭對手要與GEICO搶奪市場非常困難)

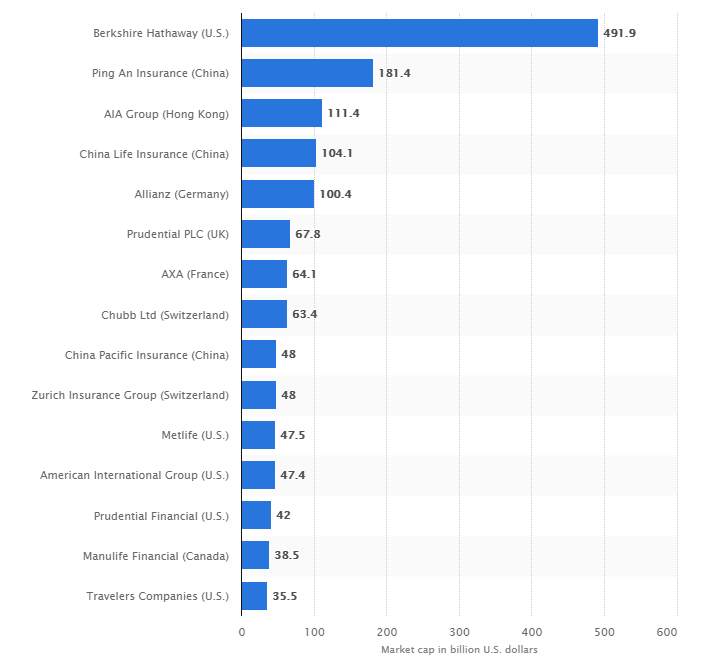

筆者在這裡再稍稍補充一些關於GEICO的資料。GEICO全名為The Government Employees Insurance Company,於1936年成立,現時為美國最大汽車保險公司之一。1951年,當畢菲特還是哥倫比亞大學商學院學生的時候,就開始投資GEICO。1996年,畢菲特收購所有餘下的GEICO股票,並將GEICO納入為旗下綜合企業巴郡的附屬公司。現時GEICO有超過1,600萬顧客,為超過2,700萬輛汽車投保。根據 Statista 網站數據,截至2018年6月,按市值計全球最大保險公司為巴郡。(筆者其實有點質疑這個數字的準確性。如果純粹比較保險公司業務,應該將GEICO的市值獨立計算,而非將整家巴郡的市值計算,因為巴郡還有很多值錢的非保險業務。)

Largest insurance companies worldwide as of June 2018, by market cap (in billion U.S. dollars)

第二至五名分別是:中國平安保險 (HKG: 2318),友邦保險 (HKG: 1299),中國人壽 (HKG: 2628),德國安聯集團。世界前五大的保險公司,有三家在香港交易所上市。值得一提的是,德國安聯集團有一個極龐大的資產管理部門,當中包括了管理全球最大債券基金的太平洋投資管理公司 (Pacific Investment Management Company, PIMCO),所以嚴格來說不是一家純保險公司。

2000年,在巴郡股東大會裡,畢菲特為巴郡的長遠發展方針表達意見:

"So we think in terms of that moat and the ability to keep its width and its impossibility of being crossed as the primary criterion of a great business. And we tell our managers we want the moat widened every year. That doesn't necessarily mean the profit will be more this year than it was last year because it won't be sometimes. However, if the moat is widened every year, the business will do very well. When we see a moat that's tenuous in any way - it's just too risky. We don't know how to evaluate that. And, therefore, we leave it alone. We think that all of our businesses - or virtually all of our businesses - have pretty damned good moats."

- 我們應從護城河角度思考,考慮一家公司能否持續保持著一道遼闊的護城河,而且不被競爭對手越過,這就是投資一家公司的首要考慮

- 我告訴我的同事,我們應該把護城河年復一年地建得更遼闊

- 更遼闊的護城河不代表更高的盈利,但長遠而言對公司的發展最為有利

- 脆弱的護城河會讓一家公司的發展承受更大風險

- 我期望巴郡的所有業務都有相當遼闊的護城河

另外,還有一隻名叫 VanEck Vectors Morningstar Wide Moat ETF (MOAT) 的交易所買賣基金,追蹤 Morningstar Wide Moat Focus Index (MWMFTR) 指數,該指數就是採納了「護城河」理念,投資於價格具吸引力 (attractively priced companies),而且有可持續性競爭優勢 (sustainable competitive advantages) 的公司。基金支出比率為0.48%,在美國市場來說並不算特別便宜,詳情可以到本博客之前另一篇文章的介紹。不過,筆者也在這裡貼上該基金的十大持股供讀者參考:

前四大持股都是醫療相關的企業,因為這些企業一般有較佳的研發能力,有各種專利項目保障產品免受競爭對手侵佔市場。第一名是輝瑞藥廠,全球最大的藥廠之一;第二及三名的 Medtronic 和 Zimmer Biomet 都是醫療設備公司,而第四名的 Biogen 則是生物科技及藥物研發公司。

- Warren Buffett on the importance of moats Link (Source: Nasdaq, 2017)

- A key to Warren Buffett's investing strategy is incredibly easy to replicate (MOAT) Link (Source: Markets Insider, 2018)

- Largest insurance companies worldwide as of June 2018, by market capitalization Link (Source: Statista, 2018)

- VanEck Vectors Morningstar Wide Moat ETF Link (Source: VanEck, 2018)

Disclaimer:

Information contained in this site does not constitute investment advice or recommendations. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk tolerance level and ability to understand the nature and risks of the relevant fund/sub-fund and product. For the nature and risks involved for individual investment products, please refer to the relevant fund documents for details. You should evaluate the information made available through the site, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information.

Comments

Post a Comment